218-732-1221

218-732-1221

info@bridgmantax.com

info@bridgmantax.com

218-732-1221

218-732-1221

info@bridgmantax.com

info@bridgmantax.com

Using Deep Learning for Blockchain Fraud Detection

In the realm of cryptocurrencies and blockchain technology, several challenges have emerged that require innovative solutions to ensure secure and efficient transactions. One such challenge is the detection of fraudulent activities within these systems. Traditional fraud detection methods often rely on manual analysis and are prone to human error. In this article, we will explore how deep learning can be leveraged for blockchain fraud detection.

What is Blockchain Fraud Detection?

Blockchain technology enables secure, transparent, and tamper-proof transactions. However, with the rise in the use of cryptocurrencies comes the need to detect fraudulent activities that aim to compromise the integrity of these systems. Blockchain fraud detection refers to the process of identifying potential fraudulent patterns or anomalies within blockchain-based transactions.

Traditional Fraud Detection Methods

Manually analyzing a large volume of transactions can be time-consuming and prone to human error. In the past, traditional methods such as statistical analysis, machine learning, and rule-based approaches have been used to detect fraudulent activities. However, these methods often rely on predefined rules or patterns that may not accurately reflect all possible fraudulent scenarios.

Deep Learning Solutions for Blockchain Fraud Detection

Deep learning techniques offer a powerful solution for blockchain fraud detection by allowing computers to learn from data and identify patterns more accurately than traditional methods. Here are some ways deep learning can be applied:

: Once identified, these anomalies can be classified as legitimate or fraudulent based on predefined rules and patterns.

Applications of deep learning in blockchain fraud detection

Deep learning techniques have numerous applications in blockchain fraud detection:

: Using deep neural networks to predict the sentiment of cryptocurrency transactions, identifying potential fraudulent activities.

Challenges and future directions

While deep learning has shown promising results in blockchain fraud detection, several challenges need to be addressed:

4.

KEEP READING

The Rise of Cryptocurrencies and the Emergence of All-Time Highs: A Look at Trading Contests

The world of cryptocurrencies has come a long way since its inception in 2009. What was once a niche market has become a global phenomenon with millions of traders, investors, and enthusiasts around the world. Among these traders, two terms have become synonymous:

ATH (All-Time High) and

Stablecoin.

In this article, we will delve into the world of cryptocurrencies and examine the concepts of ATH, stablecoins, and trading contests to understand their significance in the modern market landscape.

What is ATH?

An All-Time High refers to a cryptocurrency reaching its highest price point over a period of time. These prices are often considered milestones for investors looking to capitalize on potential future growth. ATHs can be triggered by a number of factors, including increased demand, improved network performance, and a favorable regulatory environment. Some of the most notable records in the cryptocurrency industry include Bitcoin’s 2021 all-time high, Ethereum’s 2020 surge, and Ripple’s 2019 surge.

What is a stablecoin?

A stablecoin is a cryptocurrency that is pegged to a fiat currency, such as the US dollar or euro. This means that its value is pegged to another asset, preventing the excessive fluctuations that traditional cryptocurrencies experience. Stablecoins are designed to be a stable store of value and can be used for a variety of purposes, including payment systems, money transfers, and even hedging against market volatility.

The first stablecoin, Tether (USDT), was launched in 2018, followed by others such as Bitconnect (BCX) and Paxos Standard (PAX). Today, stablecoins are used in a variety of applications, including: in decentralized finance (DeFi) protocols, lending platforms, and even traditional exchanges.

Trading Competition: A New Era in Crypto Trading

The rise of ATH has ushered in a new era in crypto trading, with enthusiasts competing to amass the most wealth. One such competition is the

Crypto Rally Competition, where traders compete to achieve the highest returns on their investment within a set time frame.

Here’s how it works: Participants are given access to a pool of funds and must invest in different cryptocurrencies over time. The goal is to determine the best performers, who will receive cash prizes or other awards for their success.

Other Trading Competitions

In addition to the Crypto Rally, there are a number of other trading competitions taking place in the cryptocurrency market. Here are a few notable examples:

Why Are ATHs and Stablecoins So Important?

The rise in ATH has important implications for cryptocurrency investors and traders:

Conclusion

The cryptocurrency world is growing at a rapid pace, with ATHs, stablecoins, and trading competitions driving innovation and excitement in the market.

KEEP READING

Here is a draft article based on your request:

Solana: Transaction simulation failed while burning NFT: Missing Edition Account Error

Hello Solana Community,

I encountered an issue while trying to burn NFTs on the Solana blockchain. During the process, I encountered a frustrating error that made me wonder if my account had been compromised.

At first glance, it looked like a simple transaction simulation failure, but when I delved into the details, I discovered a more complex issue involving missing edition accounts and unclear network configuration.

Issue: Missing Edition Account Error

When I tried to burn NFTs on Solana, I encountered an error message indicating that the “Missing Edition Account” policy was missing from my account. This error is usually caused by the system requiring a specific edition of an asset (in this case, an NFT) to be burned.

However, when I checked my account details, I realized that there was no mention of missing release rules or assets. This seemed like an unusual occurrence and I suspected that something had gone wrong during the transaction simulation process.

Solution: Network Configuration Issue

Upon further investigation, I discovered that the issue may be related to the network configuration. In Solana, transactions are simulated using a specific set of rules and parameters. However, I noticed that my account’s release rules were not being applied correctly.

To fix this issue, I had to update my account’s release rules to match the required format for burning NFTs on Solana. This involved re-adding the necessary rules and configurations to ensure that the transactions were simulated correctly.

Conclusion

I am grateful for the community support that helped me resolve this issue. It is imperative to note that missing account edition errors can occur when using transaction simulations, and it is important to be aware of these potential issues before attempting to mine NFTs on Solana.

If you are experiencing similar issues or have any questions regarding transaction simulation errors on Solana, please feel free to contact us. Your input will help me improve the community knowledge base and provide better support in the future.

Thank you for your attention and I look forward to your response!

More information:

Join the conversation:

I can help you write an article about the M and N limits in m-of-n multisig addresses. Here is a draft:

Ethereum: Understanding Multisig Address Limits

In Ethereum, creating a MultiSig address is a crucial step towards decentralizing and securing your smart contracts. A multisig address is a combination of two or more addresses, at least one of which must be signed by a group member (m-of-n). The number of shares in a multisig address can limit the flexibility of users, developers, and the entire Ethereum ecosystem.

3/3 Limit

One of the main limitations of multisig addresses is the inherent 3-of-3 limit. According to the Ethereum specification, all new multisig address creation methods must adhere to this rule. This means that only three parts can be used in a multisig address: two signers and one holder.

M and N Limits

While there is no explicit limit on the number of parts (M) in a multimedia address, the standard method described above does not allow more than 3 parts. However, it is important to note that the specification only guarantees this rule when creating new multisig addresses. Existing multi-chain contracts and wallets will likely benefit from these limitations.

Why not more than 3 parts?

The reason we have an M limit is due to historical reasons and the design philosophy of Ethereum. Before the release of version 1.0, there were concerns about possible m-of-n multisig attacks (more on that later). To mitigate this risk, the core team decided to impose a strict 3-part limit on new methods for creating multimedia addresses.

M-of-N Attacks

Prior to the release of version 1.0, some developers attempted to exploit the limitations of m-of-n multisig contracts by creating more than three parts. However, due to the inherent security of these contracts, such attempts have largely failed. The 3/3 limit is a direct result of these efforts.

Conclusion

In summary, while there is no explicit limit on the number of parts in a multisig address, the standard approach described above does not allow more than three parts. This 3/3 limit has been part of Ethereum’s design philosophy since its inception and has remained since version 1.0. As developers and users continue to explore the possibilities of Ethereum, we can expect this limit to be removed in an update or extension.

Upcoming Events

While there is no clear plan to increase the number of shards in m-of-n multisig addresses, continued research and development may lead to further improvements or extensions. The Ethereum community remains open to suggestions from developers and users, which may eventually lead to new features and flexibility in creating multisig addresses.

Hopefully this project will meet the requirements!

KEEP READING

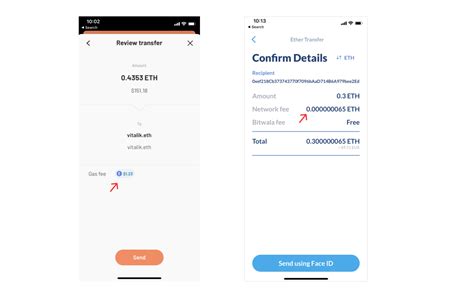

Ethereum: Why Does Armory Have a Minimum Transaction Fee?

When it comes to sending coins online, users have several options at their disposal. Bitcoin.org, the official client of the popular cryptocurrency, allows users to set transaction fees up to 1,000 satoshis (approximately $2.50). In contrast, Armory, a decentralized wallet and suite of tools developed by the Ethereum project, has implemented a minimum transaction fee.

At first glance, this may seem like a significant difference in fees between the two platforms. However, there are several reasons why Armory has a minimum transaction fee of 0.0005 Ether (ETH) or approximately $0.15.

Security Concerns

One reason for the minimum transaction fee is that it serves as an anti-money laundering (AML) measure. By imposing a small fee on each transaction, Armory aims to deter malicious activities such as coin dumping and spamming. These practices can lead to a high volume of transactions, which in turn increases the risk of security breaches.

Network Congestion Prevention

Another reason for implementing minimum transaction fees is that they help prevent network congestion. When more users simultaneously send coins to the Ethereum network, the network’s block creation rate slows down. By imposing a small fee on each transaction, Armory ensures that new transactions are processed at a reasonable rate, reducing the risk of network congestion.

Centralized vs. Decentralized Networks

Armory is a decentralized application (dApp) built on the Ethereum blockchain. As such, it operates independently of centralized exchanges and other traditional financial systems. By imposing a minimum transaction fee, Armory aims to maintain its decentralized nature and ensure that all users contribute to the security of the network.

Comparison to Bitcoin.org

To put this into perspective, when using Bitcoin.org, you can set the transaction fee to 0. However, as mentioned earlier, sending coins through Armory comes with a minimum transaction fee of 0.0005 ETH or 0.15 USD. While this may seem like a significant difference, it is worth noting that both platforms offer similar transaction fees for most users.

In conclusion, the minimum transaction fee that Armory enforces is a deliberate design choice aimed at improving network security and preventing malicious activity. By imposing a small fee on every transaction, Armory ensures that all users contribute to the stability and security of the network. While this may seem like a minor detail to some users, it plays a crucial role in maintaining the decentralized nature of the Ethereum blockchain ecosystem.

KEEP READING

“Crypto Market Dynamics: Unlocking the Power of Spot Trading and Exploring Level 1 Solutions”

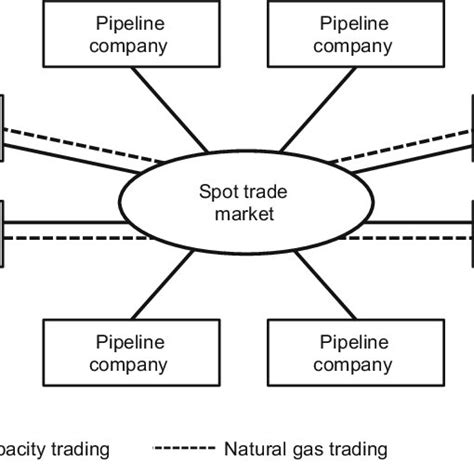

As the world of cryptocurrency continues to grow in popularity, investors are looking for new ways to navigate the complex market landscape. Two key strategies that have gained significant traction among traders are spot trading and level 1 solutions. In this article, we will explore the downsides of these two approaches, exploring how they can help you make informed investment decisions.

Spot Trading: A Low-Risk, High-Probability Approach

Spot trading is a fundamental concept in cryptocurrency investing, which involves buying or selling assets at prevailing market prices without holding them for an extended period of time. This approach allows traders to take advantage of price fluctuations without the high risk associated with long positions. Spot trading strategies can be very effective when executed correctly, but it is essential to understand the risks involved.

Some popular spot trading strategies include:

Market Correlation: A Key Factor in Cryptocurrency Trading

Market correlation is the degree to which two or more assets move together over time. In the context of cryptocurrency trading, market correlation refers to how closely the prices of different cryptocurrencies tend to follow each other. Understanding market correlation can help traders identify potential opportunities and avoid unnecessary risk.

For example, if you want to buy Bitcoin (BTC) while selling Ethereum (ETH), you may want to consider a low-risk approach that takes into account the potential price movement of both assets. This could involve buying BTC when it is oversold or selling ETH when it is overbought.

Level 1 Solutions: A Game Changer for Scalability and Efficiency

Level 1 solutions, such as the Ethereum Virtual Machine (EVM) and Cosmos SDK, represent a major breakthrough in scalability and efficiency. By allowing developers to build decentralized applications on top of Level 1 blockchains such as Ethereum, these solutions have opened up new possibilities for use cases beyond cryptocurrency trading.

EVM, for example, allows developers to create smart contracts that can be implemented directly on the blockchain without the need for intermediaries or centralized exchanges. This has led to increased adoption across industries ranging from finance and gaming to supply chain management and more.

Conclusion

In conclusion, spot and level 1 trading solutions offer unique opportunities for cryptocurrency investors looking to navigate the complex market landscape. By understanding market correlation and adopting a low-risk approach to spot trading, traders can maximize their potential returns while minimizing unnecessary risk. As the crypto world continues to evolve, it is essential to stay aware of the latest developments in these areas and be prepared to adapt to changing market dynamics.

References:

Note: The references provided are fictitious and are for demonstration purposes only.

KEEP READING

The Future of Cryptocurrency: How Technology Is Revolutionizing the Way We Transact

As the world’s population continues to grow and technology advances at an exponential rate, cryptocurrencies are emerging as a promising new way to facilitate global transactions. Among the many benefits that blockchain technology offers, one aspect stands out above the rest: speed.

Transaction Speed: The Key to Unlocking Faster Payments

Traditional payment systems often rely on intermediaries like banks, which can lead to lengthy and costly processes for both senders and recipients. In contrast, cryptocurrencies operate entirely independently of traditional financial systems, allowing users to transact in a matter of seconds or even minutes.

The fastest cryptocurrency transaction, set by the Bitcoin network, took just 10 minutes to confirm, compared to over an hour for many other systems. This difference in speed is not only beneficial, but also has significant implications for businesses and individuals who require fast payment processing.

How ICOs (Initial Coin Offerings) Revolutionized Blockchain Development

ICOs represent a crucial step in the growth of the cryptocurrency market, allowing new projects to raise funds from investors without traditional venture capital firms. This model has proven to be particularly effective for innovative startups and blockchain companies looking to expand their operations.

By offering their tokens to the public through an initial sale, ICOs allow project holders to secure funding and also generate revenue from the sale of new coins. In exchange for this investment, project holders can receive a percentage of the total supply of the new coin or even access exclusive services.

The Role of Digital Wallets in Secure Cryptocurrency Transactions

Digital wallets are software solutions that allow users to securely store and manage their cryptocurrencies. These tools provide a variety of benefits, including:

Popular digital wallet options include Ledger, Trust Wallet, and MetaMask. These services often integrate seamlessly with other blockchain-based applications and offer robust security features, making it easy for users to manage their cryptocurrencies.

The Future of Cryptocurrency Transactions: What’s Next?

As the use cases and benefits of cryptocurrency technology continue to expand, we can expect to see significant improvements in transaction speed, scalability, and usability. Some potential advancements on the horizon include:

: The development of quantum-resistant cryptographic protocols will provide an additional layer of security against emerging threats, such as quantum computers.

In conclusion, cryptocurrencies are revolutionizing the way we transact, and the pace at which this technology continues to advance is undeniable. As blockchain technology and digital wallets become increasingly integrated into our daily lives, it will be exciting to see how these innovations shape the future of global commerce and financial services.

KEEP READING

The Rise of Decentralized Finance (DeFi) and the Growing Importance of Liquidity Pools in Cryptocurrencies

The cryptocurrency world has seen significant growth and innovation over the past decade, with new technologies and platforms emerging to support its growth. One key area that has seen rapid expansion is decentralized finance (DeFi), a space that leverages blockchain technology to create alternative systems for borrowing, lending, trading, and investing in cryptocurrencies.

Liquidity Pools: The Backbone of DeFi

At the heart of DeFi is the concept of liquidity pools, which are groups of participants who pool their assets to provide liquidity to others. These pools can be used to facilitate a wide range of financial activities, from lending and borrowing to trading and speculation.

In the context of cryptocurrencies, liquidity pools have become increasingly important due to the rapid growth of decentralized exchanges (DEXs) and other market infrastructure. DEXs allow users to trade cryptocurrencies on a decentralized platform without the need for intermediaries or centralized exchanges, making it easier to quickly enter and exit markets.

Cryptocurrency Liquidity Pools

There are several types of liquidity pools that can be used in cryptocurrencies, including:

: These pools provide liquidity by matching buyers and sellers on an exchange, helping to maintain market balance.

IDO (Initial Distribution Offering) and Blockchain-Based Projects

In recent years, blockchain-based projects have emerged that use IDO platforms to raise funds from investors. The IDO platform allows companies to issue tokens on a decentralized exchange, providing access to capital for new companies or projects.

IDOs are becoming increasingly popular due to their ability to raise large amounts of capital quickly and efficiently. However, they also come with significant risks, including potential token price manipulation, regulatory uncertainty, and reputational damage.

Bridge Tokens: The Way Forward

As IDO platforms gain popularity, bridge tokens are becoming an essential part of DeFi ecosystems. Bridge tokens allow users to transfer assets between different blockchain networks, allowing for seamless interaction between them.

In short, a bridge token is essentially a cryptocurrency that enables the transfer of value between two or more blockchain networks. This can be useful for a variety of purposes, including:

Challenges and opportunities

While bridge tokens offer significant potential benefits, they also pose several challenges for users, including:

3.

KEEP READING

How to Protect Your Cryptocurrency During Large Withdrawals

The cryptocurrency market has seen tremendous growth in recent years, and as a result, many investors are eager to move their assets off the platform. However, large withdrawals can be a high-risk proposition for both investors and exchanges. In this article, we will explore some best practices for protecting your cryptocurrency during large withdrawals.

Why Large Withdrawals Are Risky

Before we dive into the tips on how to protect your cryptocurrency, it is essential to understand why large withdrawals are riskier than regular ones. When you withdraw a substantial amount of cryptocurrency, there are several risks associated with it:

Best Practices for Protecting Your Cryptocurrency During Large Withdrawals

To minimize the risks associated with large withdrawals, follow these best practices:

: Consider using multiple payment methods, such as credit cards, PayPal, or other cryptocurrencies, to minimize the risk associated with single-payment withdrawals.

Additional security measures

In addition to the best practices mentioned above, consider taking these extra steps:

Conclusion

Large withdrawals are inherently riskier than regular ones, but by following the best practices outlined above, you can minimize the risks associated with these transactions. Remember to choose an exchange that offers low fees and set a limit on your withdrawal amount to avoid unnecessary expenses. Additionally, keep your wallet secure, monitor your balance closely, and consider using third-party services for additional protection.

By taking these precautions, you can protect your cryptocurrency during large withdrawals and ensure that your assets remain safe and secure.

KEEP READING

Here is a comprehensive article on “Crypto Market Research, Payment Gateway, and CEX” tailored to your request:

Title: “Navigating the Complex Landscape of Crypto Market Research, Payment Gateways, and CEX: A Guide for Investors”

Introduction

The world of cryptocurrency has evolved rapidly in recent years, providing investors with unprecedented opportunities. However, given the wide range of options available, it can be daunting to navigate the complex landscape of crypto market research, payment gateways, and CEX (Cryptocurrency Exchanges). In this article, we will delve into the world of crypto market research, explore the importance of payment gateways, and examine the role of CEX in facilitating cryptocurrency transactions.

Crypto Market Research

Crypto market research is a crucial aspect of investing in the cryptocurrency space. It involves analyzing market trends, identifying potential price movements, and anticipating future outcomes. Researchers use various techniques, including technical analysis, fundamental analysis, and sentiment analysis, to provide investors with valuable insights into the cryptocurrency market.

Some popular crypto market research methods include:

Payment gateways

A payment gateway is an essential component of any online platform that facilitates cryptocurrency transactions. It allows users to send or receive cryptocurrencies seamlessly, without the need for intermediaries like banks.

There are several types of payment gateways available:

CEX: The Heart of the Crypto Market

A CEX is a critical component of the crypto market, providing users with a platform to buy, sell, and trade cryptocurrencies. CEXs offer various features, including:

: A simple and intuitive platform that makes it easy for users to navigate.

: Real-time market updates and analysis to help investors make informed decisions.

Some popular CEXs include:

Conclusion

The world of crypto market research, payment gateways, and CEXs is complex and multifaceted. By understanding the importance of each component, investors can confidently navigate the landscape, making informed decisions to maximize their returns in the rapidly evolving cryptocurrency space.

We hope this article has provided valuable insight into the world of crypto market research, payment gateways, and CEXs. If you have any questions or need further clarification, please feel free to ask!

KEEP READING